Experience You Can Trust

Deciding whether Chapter 7 or Chapter 13 is for you

If you have fallen behind on your bills, you may be considering bankruptcy, but are not sure which type would be right for you. As an individual, you have a choice between Chapter 7 and Chapter 13 bankruptcy. Although both types of bankruptcy can stop harassing phone calls from your creditors and discharge most of your debt, they have different approaches. It is therefore important to have a basic understanding of how each type differs when deciding which option would best fit your situation.

Chapter 7

During Chapter 7, the court appoints a trustee to sell any unencumbered and nonexempt assets that you have. Once any non-exempt assets have been sold, any proceeds are applied to your debt. Although this sounds like a scary thought, the overwhelming majority of those filing Chapter 7 have no assets that unencumbered or exempt from the sale, as exemption laws protect the most important assets such as furniture, houses and cars. As a result, most do not lose anything during the process. Once the sale has been completed (if there is one), most unpaid debt is discharged.

The principal advantage of Chapter 7 is that it is a fast process. This type of bankruptcy typically takes as little as three months. However, if you are facing foreclosure, Chapter 7 may not be the best solution. Although Chapter 7 can temporarily stop foreclosure proceedings, it cannot permanently stop them, unless the mortgage is kept current throughout the process. In addition, Chapter 7 may not be available as an option for those with significant disposable income, as all filers must pass a means test before qualifying.

Chapter 13

Chapter 13 has a different approach to debt relief than Chapter 7. Instead of a sale, Chapter 13 consolidates your debts into a payment plan. Each month, you make a payment towards your debts for a three to five-year period. Although it seems like your would have to repay all of your debts in Chapter 13, this is not the case. Under the bankruptcy laws, your unsecured debt (medical bills and credit cards) is paid last. Depending on your situation, this potentially means that you end up paying little or none of this type of debt. After the payment plan has been completed, most unpaid debt is discharged.

Chapter 13 is ideal for those facing foreclosure or who have significant nonexempt assets that may be lost during the Chapter 7 process. Once filed, Chapter 13 stops foreclosures and allows you to catch up on the missed payments through the payment plan. The lender may not begin foreclosure proceedings as long as you continue making payments under the plan. Once the process is complete, you emerge from Chapter 13 current on your mortgage.

The chief disadvantage of Chapter 13, aside from its length, is that it requires a minimum level of income. To qualify, it is required to show that you have a regular source of income in order to apply towards your debts. As a result, some in a position to file bankruptcy may not qualify for Chapter 13.

If you are struggling with debt, it is important to act before the situation worsens. An experienced bankruptcy attorney can consider your situation, advise you on how it would be affected by bankruptcy, and recommend an option that would best protect your assets while relieving you of your unmanageable debt.

Tell Us How We Can Help

Bold labels are required.

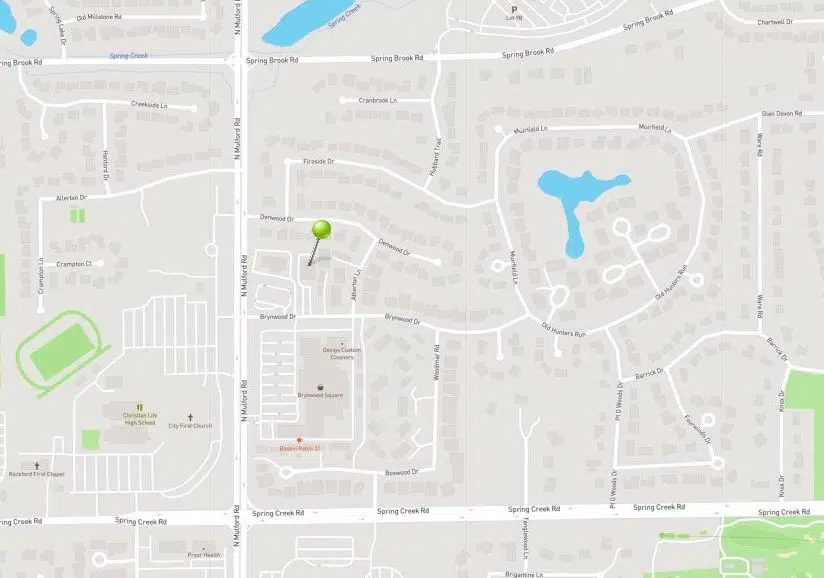

Davitt Law Office, PLLC

6072 Brynwood Drive, Suite 206

Rockford, IL 61114

Phone: 815-229-5333

Fax: 815-229-0733