Experience You Can Trust

What Are The Current Bankruptcy Laws?

Bankruptcy Abuse Prevention And Consumer Protection Act Of 2005

The following is a summary of some of the most significant changes under the new bankruptcy law, which became effective on October 17, 2005.

Means Testing

Under the new bankruptcy law, debtors whose debts are mainly consumer debts, must undergo a “means testing” analysis to determine whether they are eligible for filing a Chapter 7 bankruptcy. If the debtor’s income exceeds the median income for their size household in the state where they live, further financial analysis will be required to determine whether they qualify for Chapter 7. If they do not qualify to file under Chapter 7, they may need to propose a three to five year payment plan in a Chapter 13 bankruptcy case. Clients should consult an experienced bankruptcy attorney to evaluate their personal situation.

If a debtor’s debts are mainly business related debts, the means test is not required.

Prebankruptcy Counseling

Before your bankruptcy case can be filed, you must complete a credit counseling session through one of the agencies which have been approved by the Office of the U.S. Trustee. This counseling session can be done in person, on the telephone or on the Internet, and should take approximately 45 minutes to complete. When you have completed this session, the agency will provide you with a certificate of completion which we must file with the court at the time your bankruptcy petition is filed.

Post-Bankruptcy Counseling

After your bankruptcy case is filed, but before you receive your discharge, you must complete a financial management course through one of the agencies approved by the Office of the U.S. Trustee. This course can also be competed in person, on the telephone or on the Internet, and will take approximately two hours. We need to file the certificate of completion with the court in order for your discharge to be issued.

Get The Most Up-To-Date Information From An Attorney

Please contact us online or call 815-229-5333 or 800-207-5133 today for a free bankruptcy consultation.

We are a debt relief agency. We help people file for bankruptcy relief under the Bankruptcy Code.

Tell Us How We Can Help

Bold labels are required.

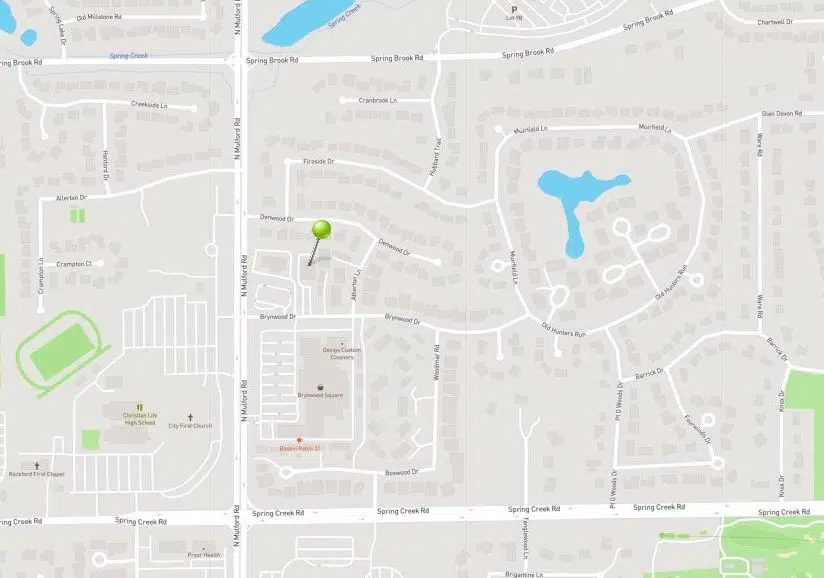

Davitt Law Office, PLLC

6072 Brynwood Drive, Suite 206

Rockford, IL 61114

Phone: 815-229-5333

Fax: 815-229-0733