Experience You Can Trust

Understanding Chapter 7 And 13 Bankruptcy

These are confusing times for people who find themselves over their heads in debt. First, they wonder:

- Do I Qualify to file Chapter 7 Bankruptcy?

- Can credit cards still be discharged in bankruptcy?

- Is there any way to get a fresh start?

- Is there any solution other than filing bankruptcy?

You may wonder whether you are eligible for bankruptcy under the new bankruptcy law everyone has heard so much about. Finally, you may decide, “Okay, I need to look at bankruptcy, but where do I start?”

Chapter 7 And Chapter 13 Bankruptcy

The expert bankruptcy attorneys at Davitt Law Office, PLLC are ready and eager to help you. Over the years, our bankruptcy attorneys have assisted thousands of clients through bankruptcy. We have provided personalized and professional assistance to people with debt problems who need a fresh start. If you are considering Chapter 7 or Chapter 13 bankruptcy, contact a well-qualified bankruptcy lawyer at Davitt Law Office, PLLC today.

You will personally meet with an experienced bankruptcy attorney who will personally handle your case. We will thoroughly analyze your entire financial situation and explain the bankruptcy law in language you can understand. We will help you determine whether you are eligible for a Chapter 7 bankruptcy, or whether a Chapter 13 would better meet your needs. Although the means testing provisions of new bankruptcy law makes some people ineligible for relief under Chapter 7, a repayment plan under Chapter 13 may provide the help you need. In any bankruptcy case, the person filing bankruptcy is allowed to keep certain assets that are protected by Illinois’ Bankruptcy Exemption laws.

Chapter 7 Bankruptcy

A Chapter 7 bankruptcy is the most common type of bankruptcy and is often referred to as a “liquidation case.” In a Chapter 7 case, a Chapter 7 trustee is appointed to evaluate whether the debtor has any nonexempt assets which could be liquidated to pay the claims of creditors. In a Chapter 7 bankruptcy, debtors are allowed to retain certain “exempt assets,” including clothing, household goods, retirement funds and specified amounts of equity in a homestead and motor vehicle. In most cases, the bankruptcy court enters a discharge order which discharge’s the debtor’s debts within approximately 3 ½ months after the bankruptcy case is filed.

- How Chapter 7 bankruptcy works

- Learn about the means test

- Learn about Chapter 7 bankruptcy reaffirmation agreements

Chapter 13 Bankruptcy

A Chapter 13 bankruptcy is a more complex type of bankruptcy case in which the debtor proposes a Chapter 13 Plan to repay all or a portion of his or her debts over a period of 3 to 5 years. If the Chapter 13 plan meets all the requirements of the Bankruptcy Code, the bankruptcy court will confirm the plan. After the debtor has completed all of the payments under the Chapter 13 plan, the bankruptcy court will enter a discharge order. Chapter 13 bankruptcy may be used to cure delinquent mortgage payments over the term of the Chapter 13 plan.

Contact Us

Contact us online, or call 815-229-5333 or 800-207-5133 to arrange a free consultation with one of our experienced Rockford bankruptcy lawyers.

We are a debt relief agency. We help people file for bankruptcy relief under the Bankruptcy Code.

Tell Us How We Can Help

Bold labels are required.

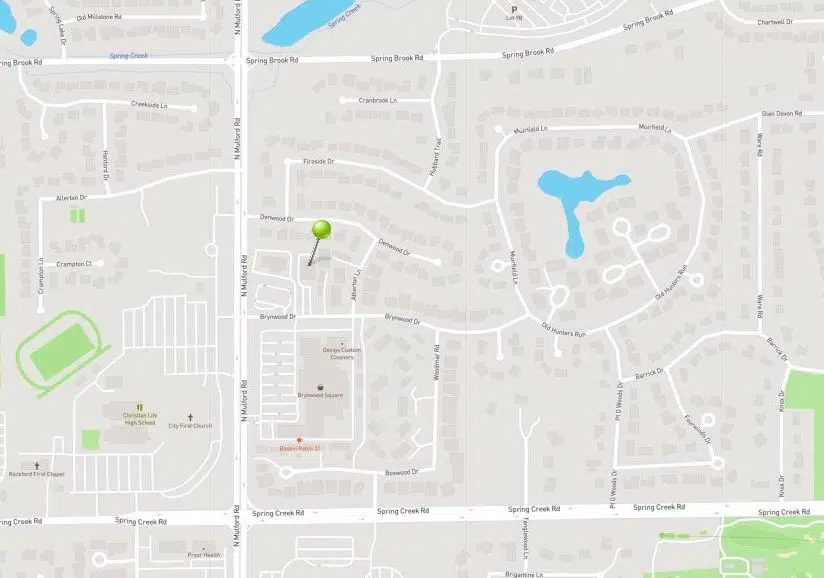

Davitt Law Office, PLLC

6072 Brynwood Drive, Suite 206

Rockford, IL 61114

Phone: 815-229-5333

Fax: 815-229-0733