Experience You Can Trust

Owe income taxes? Here’s how bankruptcy may help

Although many people assume bankruptcy can quickly help relieve them of their income tax debt, this is not always the case.

With April 15 less than a month away, this time of year is hardly the most popular annual rites for many. However, for people struggling to pay income taxes for prior years, this is an especially unpleasant time. If you are in this situation, you may have considered bankruptcy as a way out. Before you file, however, it is important to understand how it can and cannot help you with this special type of debt.

How bankruptcy affects taxes

Many people assume that income tax debt is treated like other types of debt in bankruptcy in that it is quickly wiped away soon after filing. However, unlike credit card or medical debt, income tax debts are treated differently in bankruptcy. Income tax debt does not always qualify for discharge; it must first meet several criteria:

• The tax debt must have been assessed by the IRS at least 240 days before the bankruptcy was filed.

• The tax return for the debt must have been filed a minimum of two years prior to the bankruptcy. If the return was filed late, it may seriously hinder the ability to obtain a discharge.

• The taxes must have been owed for at least three years. If the IRS granted an extension, three years must have passed since the extension date.

• The taxpayer must not have attempted to evade or defeat his or her taxes.

If your income tax debt meets these standards, it may qualify for a discharge in bankruptcy. Additionally, any late payment penalties or interest accrued may be discharged.

On the other hand, if your income tax debt is not eligible for a discharge it must be repaid. However, all hope is not lost. Bankruptcy can make paying the debt more manageable. If your income tax burden is small compared to your other debts, Chapter 7 bankruptcy may be especially helpful. It can eliminate your obligation to repay many of your unsecured debts (i.e. credit cards, medical bills and personal loans), which will free up more income to pay your tax debt.

If, however, your income tax debt comprises a large portion of your total debts, Chapter 13 may be a better solution. In this type of bankruptcy, your tax debt becomes part of a payment plan. Under the plan, you make monthly payments towards your back taxes over a three to five-year period. During this time, the IRS cannot attempt to collect your tax debt or garnish your wages. After the payment period is completed, you emerge fully paid on your taxes and free of most other debts.

Consult an attorney

Although bankruptcy can help many with their tax problems, it should not be considered a viable solution for every situation. In order to find out the best solution for your situation, speak with an attorney. The experienced bankruptcy attorneys at Schlueter Ecklund & Davitt can consider the financial straits that you are in and recommend the best way to alleviate your troublesome situation.

Tell Us How We Can Help

Bold labels are required.

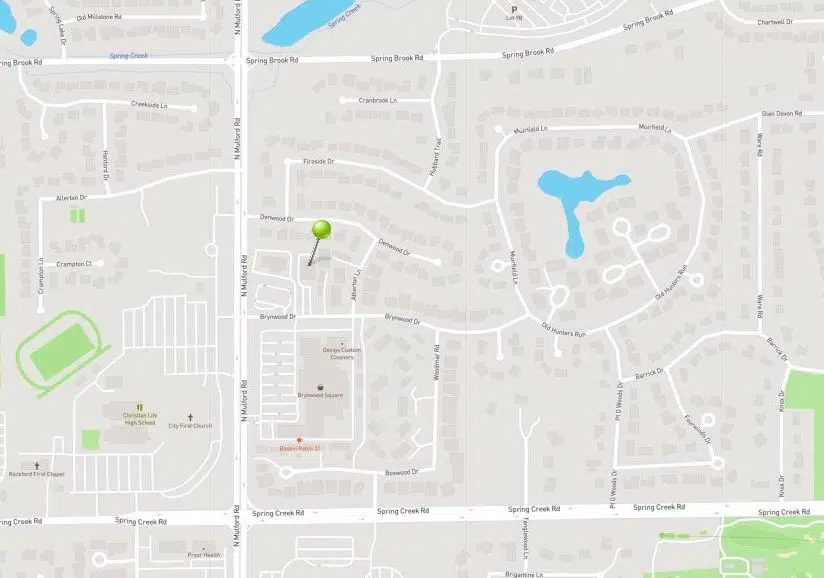

Davitt Law Office, PLLC

6072 Brynwood Drive, Suite 206

Rockford, IL 61114

Phone: 815-229-5333

Fax: 815-229-0733